The first ever academic conference on the European Investment Bank has been successfully concluded in Luxembourg in 2019.

"Deciphering the European Investment Bank: History, Politics, and Economics ", the first ever academic book on the European

Investment Bank has been published by Routledge in June 2022 and is available on Routledge, amazon and other book e-selling sites.

CALL FOR PAPERS

CONFERENCE

European Public Banks and their Development Role:

Interdisciplinary approaches to understanding the past, present and future of European development finance

Date: July 21st and 22nd July 2022

Venue: University of Luxembourg

Sponsored by the Robert Schuman Initiative for European Affairs and the Institute of Political Science of the University of Luxembourg, The University of Manchester and The University of Padova

The first ever academic book on the EIB is coming up by Routledge in June 2022

EIB CONFERENCE 2019

IN LUXEMBOURG

THE FIRST EVER ACADEMIC CONFERENCE ON THE EUROPEAN INVESTMENT BANK SINCE ITS CREATION IN 1958 HAS BEEN HELD AT THE UNIVERSITY OF LUXEMBOURG

LUXEMBOURG PARTICIPANTS END OF CONFERENCE PHOTO

NEWS AND UPDATES

This section gives regular updates on the progress of the Conference.

CHECK HERE TO KEEP YOURSELVES UPTO DATE FOR OUR ACTIVITY

CALL FOR PAPERS

CONFERENCE

European Public Banks and their Development Role:

Interdisciplinary approaches to understanding the past, present and future of European development finance.

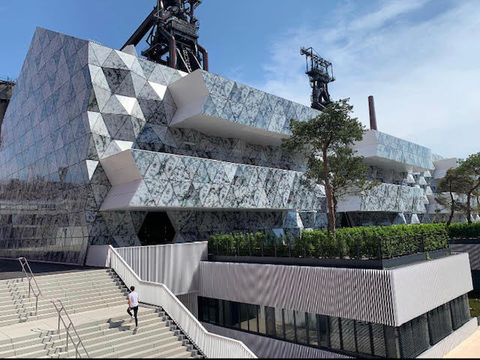

Venue: University of Luxembourg, Belval Campus, 11, Porte des Sciences, 4366 Esch sur Alzette, Luxembourg

Sponsored by the Robert Schuman Initiative for European Affairs and the Institute of Political Science of the University of Luxembourg, The University of Manchester and The University of Padova

Date: July 21st and 22nd July 2022

All too often following recent economic, migration and health crises, scholarly attention has focused on the universal development banks rather than exploring their regional and national counterparts. Where are the Public Development Banks (PDBs) in these crises? With notable exceptions we are left with an almost blank slate for contemporary engagement with European PDBs in particular.

This is a curious anomaly as since World War II existing PDBs have been strengthened while new ones have been established to promote economic reconstruction and growth. The increased role the European Union and its member states have carved out for themselves internationally positions the European PDBs at the forefront of the development finance system. Given their financial firepower, mandates and expertise, the European PDBs have been called to align to the Paris Agreement and the EU’s 2030 Agenda for Sustainable Development, and jointly supporting through their own and ‘Team Europe’ funds, a more open, integrated and coordinated development impact. Their ability to cooperate with multiple public and private, international and local stakeholders, and their wide range of financial tools, is central to contemporary efforts to build back better.

The European PDBs have steadily gained prominence at national, European and international level as instruments of economic diplomacy, serving foreign policy and geostrategic objectives. They constitute an important, yet under studied component of the European and international political and financial architecture. These institutions are situated among a growing network of embedded multilateral development arrangements that traverse multiple overlapping sovereignties, and operate at the global, international, regional, intra-regional, national and sub-national scales. The European PDBs have both regional and non-regional members and are ostensibly engaged in channeling financial and technical assistance to public and private borrowers while simultaneously disseminating knowledge, regimes, standards, and rules at the regional level in the broad context of development.

Despite their crucial role, research interest has been sporadic and not commensurate with their role. The limited literature that exists on the European PDBs tends to identify technical differences in terms of their origins, their institutional structures, lending processes and analyses their effectiveness in setting regional agendas. There is of course though a veritable landslide of material produced by the European PDBs themselves, as even the most cursory glance at their institutional websites affirms, and the PDBs remain a key source of data for the maintenance of economic modalities.

Our starting point is a relatively straightforward puzzle: why are the European PDBs under-explored across the academic literature? Our conference aims to bring together scholars from across different disciplines with pluralist methodologies to analyse the governance, operation, effectiveness, policies and long-term evolution of the European PDBs and their relevance to past, present and future development challenges.

We welcome conference papers from any social science field related to the European PDBs, including but not limited to critical engagement with the following topics:

-

The priorities and determinants of PDB lending policy and their field of operations;

-

PDB funding and borrowing policy (own funds and debt markets);

-

The effect and impact of PDBs operations on development;

-

PDB financial instruments (loans, guarantees, equity participations and technical assistance grants);

-

PDB business models and their evolution;

-

PDB decision-making and management, and the efficiency and effectiveness of operations;

-

Role of and relationships with non-state actors such as central banks, private banks, local development institutions, civil society, and other non-state actors;

-

Specific individuals who might be singled out for their role and influence in the operation of PDBs;

-

Horizon scanning analysis of PDBs future relevance in global transformations of political, social, economic, technological, environmental and geopolitical nature;

For each topic we are interested in examining continuities as well as change. Recognizing the broad scope of the topic, we are also happy to consider other contributions within the broad scope of the subject of European PDBs.

Submissions

Authors are invited to submit an abstract (500 words) together with a brief bio to conferenceeib2022@gmail.com no later than 7 March 2022.

Accepted contributors will be communicated by 15 April 2022 and a paper of between 6000 to 10000 words (inclusive of references) must be submitted by 1 July 2022.

Expenses

Reasonable (economy fare) travel and hotel costs will be covered by the organizers.

Publishing plans

It is our aim that a selection of papers from the conference be published in a journal special issue and an edited volume with a leading academic publisher

For the Scientific Committee

Lucia Coppolaro, Associate Professor of International History, University of Padova, lucia.coppolaro@unipd.it.

Helen Kavvadia, Researcher in Residence, Institute of Political Science, University of Luxembourg, helen.kavvadia@ext.uni.lu.

Stuart Shields, Senior Lecturer in International Political Economy, The University of Manchester, stuart.shields@manchester.ac.uk.

Updated 10/02/2022

NEWS AND UPDATES

SUBMISSION OF ABSTRACTS SUCCESSFULLY CONCLUDED

CEIB2019 extends our thanks to all who submitted proposals for the Conference. Accepted contributions will be communicated by January 17, 2019.

Updated 04/01/2019

NEWS AND UPDATES

SUBMISSIONS FAR EXCEEDED EXPECTATIONS

The Scientific Committee extends our thanks to all who submitted proposals for the Conference.

The number of submissions far exceeded our expectations, as scholarly work on the EIB had been limited to date, and the selection process is proving very demanding. We kindly therefore ask for your understanding for not being able to respond to you as promised by the 17th January 2019.

We will do our best, to come back to you as early as possible, and we thank you again for your interest in the Conference.

Updated 17/01/2019

NEWS AND UPDATES

WORKING TOWARDS A BALANCED CONFERENCE PROGRAM

The Scientific Committee having responded to all who submitted proposals for the Conference, has started working on developing a balanced conference program.

The proposals to be presented fall in four broad categories, ie history, economics, political science and different other areas, including law, engineering, and decision-making, confirming the interdisciplinary nature of the Conference, while the geographical distribution of the originating academic institutions spread over eleven different countries assures its international character.

The Scientific Committee looks forward to welcoming the participants at the University of Luxembourg in July 2019!

Updated 06/02/2019

NEWS AND UPDATES

THE ORIGINAL DEADLINE FOR SUBMISSION OF 12 JUNE 2019, HAS BEEN EXTENDED TO 28 JUNE 2019.

Given that a few papers were late, the Scientific Committee has decided to extend the deadline for full paper submission to 28 June 2019. The Conference program will be published after reception of all papers to be presented.

Updated 12/062019

NEWS AND UPDATES

SECOND LEG OF CONFERENCE DECIDED TO BE HELD IN ITALY EARLY 2020

The Call for Papers was launched in November and by the deadline date early this year, we received a wealth of interesting and well-qualified submissions, coming from the EU, USA, India and New Zealand. The submissions cover a wide range of scientific disciplines ranging from history, economics, political science, law, engineering, business etc. The number of submissions far exceeded our expectations, as the topic is very narrow and scholarly work on the EIB had been limited to date.

The quality of the submissions is such that we are setting our sights on a follow up conference in Italy near the end of 2019 or early 2020.

Updated 17/01/2019

NEWS AND UPDATES

THE FIRST EVER ACADEMIC CONFERENCE ON THE EIB HAS BEEN SUCCESSFULLY CONCLUDED

The judicious mix of well known and widely cited scholars working on the EIB, with new ones with an interest on the topic stimulated further academic interest, provoked fruitful discussions, enriched knowledge and allowed us to establish a network of researchers of the subject.

Updated 12/07/2019

NEWS AND UPDATES

Updated 02/11/2020

WORKING TOWARDS THE PADOVA WORKSHOP PROGRAM

The program will include aspects of EIB activity in Italy given in a historical perspective. Well known and widely cited scholars have declared interest to present their research.

NEWS AND UPDATES

Updated 10/12/2020

THE WORKSHOP IN PADOVA HAS BEEN SUCCESSFULLY CONCLUDED

Attended by some 20 scholars linked remotely the workshop has enriched academic knowledge on the EIB by shedding light in the role and activity of the EIB in Italy during the period 1958-1973. For a brief wrap-up please look to the relevant Press Release dated 10.12.2020.

EIB CONFERENCE IN SEARCH OF NEW IDEAS AND COOPERATIONS

What, why, Where, and When?

We will be pleased to hear from you if you wish cooperation on the EIB for:

-

specific research interests related

-

research projects

-

publication projects

-

conference organisation

-

academic speaker assignments

Our contact details:

Helen Kavvadia

MSH3-1, University of Luxembourg,

Campus Belval, 11, Porte des Sciences, 4366 Esch sur Alzette, Luxembourg

+ 352 466644 9389

THE CONFERENCE STIMULATED ACADEMIC INTEREST ON THE EUROPEAN INVESTMENT BANK

NEWS AND UPDATES

THE FIRST EVER EDITED VOLUME ON THE EUROPEAN INVESTMENT BANK IS CURRENTLY AT THE FINAL STAGE

The edited volume is expected by early 2022. It will include Insightful analyses from historical, political, legal and economic perspective.

More details to be announced by August 2021.

Updated 01/06/2021

THE UNIVERSITY OF PADOVA

THE UNIVERSITY OF LUXEMBOURG

Belval campus

COPYRIGHTS

The EIB Conference logo is copyright material of Helen Kavvadia.

The photos of participants at the EIB are copyright material of Marlène Hignoul.

The University of Luxembourg and the University of Padova photos are copyright material as referred on their sites.